The Ether options-trading boom is still far from reaching its peak of early May

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of U.Today. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

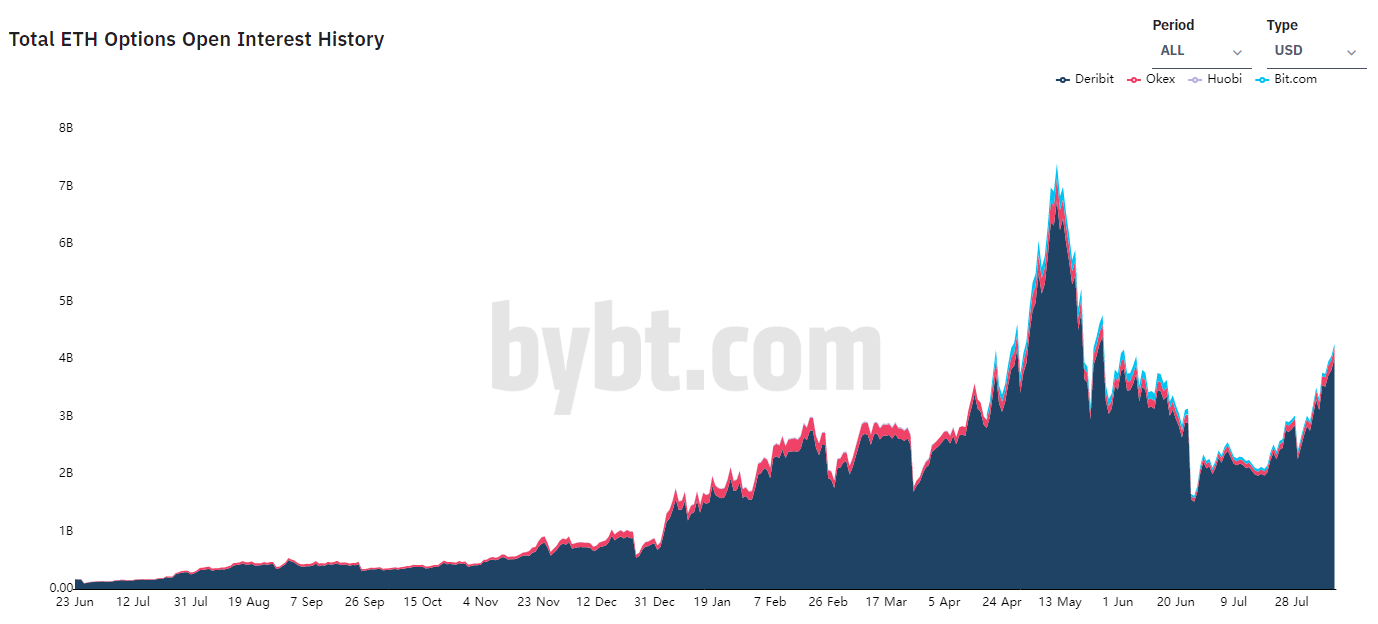

According to data provided by Bybt, open interest in Ethereum options has reached $4 billion—its highest level since late May.

Dutch derivatives exchange Deribit accounts for almost the entire sum, with OKEx coming in a very distant second place with $184 million worth of OI.

Options—which are used both for hedging and risky speculation—saw a huge drop in open interest back in June when the whole market was coming to terms with a severe correction.

On June 26, Ether options OI dropped to just $1.62 billion, the lowest level since early January.

This happened just a little over a month after it reached its peak of $7.4 billion on May 12. This coincided with Ether logging its current all-time high of $4,356.

An ominous sign?

The revival of the Ether options-trading craze may be a sign that the market was getting overheated given that it came on the brink of an ongoing pullback.

Earlier today, Ether came awfully close to breaking below $3,000 on the Bitstamp exchange amid broader market weakness.

That said, a healthy call-put ratio of 1.81 signals that the options market is now bullish after a strong recovery.

.jpg)

.jpg)

.jpg)